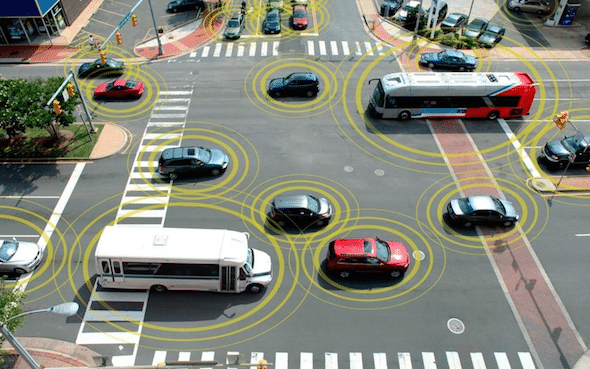

Telematics in 2021: Have We Reached the Tipping Point?

Consumers may be ready to embrace telematics – even if insurance professionals don’t realize it yet. Here’s why 2021 may see a surge in the use of telematics. Business Owners Are Interested in Telematics Insurance agents are missing out on opportunities if they don’t talk to their commercial auto clients about telematics. That’s a takeaway […]

Continue readingPlanning for 2021 Tech: Four Key Considerations

Are you ready for 2021? 2020 has brought unprecedented challenges and rapid transformations. Consumer expectations have changed, and insurers need the right technology if they want to maintain a competitive edge. As you prepare the new year, take some time to assess your readiness in the following areas #1 Your Policyholder Mobile App Pew Research […]

Continue readingThree Direct-to-Consumer Insurance Sales Trends You Can’t Afford to Ignore

The direct-to-consumer (D2C) model has gained steam in recent years, and it shows no sign of slowing down. Consumers comparison shop for everything online – from cars to smartphones. New data reveals that they have the same shopping expectations for insurance. Trend #1: The D2C Model Earns the Most Market Share for Past Two Years […]

Continue readingWill P&C Insurers Be on The Hook for Business Interruption?

The P&C insurance industry might not be as immune to COVID-19 as previously assumed. Although many P&C policies exclude losses caused by communicable diseases, insurers may still end up on hook for coronavirus-related business interruption. Business Interruption Like Never Seen Before Right now, an unprecedented number of businesses are dealing with business interruption due to […]

Continue readingHow Auto Insurers Can Win Gen Z Drivers

A new generation is stepping into the driver’s seat. Here’s what auto insurance can do to earn their business. Getting to Know Gen Z According to Pew Research Center, the cutoff year for Millennials is 1996. Anyone born between 1997 and about 2012 belongs to Generation Z. In 2020, the oldest Gen Z members are […]

Continue readingDon’t Get Bitten by EKANS, the Newest Ransomware Risk

Is there a snake in your computer system? Snake ransomware has emerged as a new threat, and industrial control systems could be at risk. The malware is also called EKANS, the backwards spelling of snake – but whichever term people use, it’s got a venomous bite. Here’s how this new cyberattack could threaten your operations. […]

Continue readingIs Location Data Fair Game for Auto Insurance Claims Adjusters?

Let’s say that an adjuster is reviewing a suspicious claim. The claimant’s story doesn’t seem quite right, but there’s no way to prove it. Could location data be the answer? Phones continuously communicate with cell phone towers. So theoretically, if something seems wrong, location data could be used to corroborate the story, providing the information […]

Continue readingBias in Insurance Underwriting: Does AI Help or Hurt?

In insurance, pricing varies with risk, and risk is a pretty situational concept. Different people face different degrees of it, and “no two people are entirely alike,” said Daniel Schreiber at Insurance Thought Leadership. Individuality is part of the picture. The problem is, when making individualized decisions, bias is sure to play a role in […]

Continue readingAuto Insurance Shopology: New Study Highlights

Last year, LexisNexis Active Insights released a new report – “Insurance Shopology” – all about the way people shop for insurance. After combing through the findings, we’d like to share the highlights with you. How’s the market? Here’s the big picture New auto insurance customers are entering the market en masse, and insurers are seeing […]

Continue readingImagining the Insurance Business in 5G

If you’ve read much yet about 5G, you’ve probably heard plenty of starry-eyed imaginings about what this new development will mean for insurers in the future. Is it “about to change everything again,” as described here by Insurance Thought Leadership (which compared 5G to the invention of the wheel)? Beyond the hype, what can we […]

Continue reading