Should You Insure Cannabis Companies?

Cannabis is growing in America – and so is the consumption of it. As the demand for dispensaries continues to rise, what are the risks for insurers? Let’s review the pros and cons. Cannabis is becoming more and more common According to the information resource Leafly, cannabis products are now legal to sell and consume […]

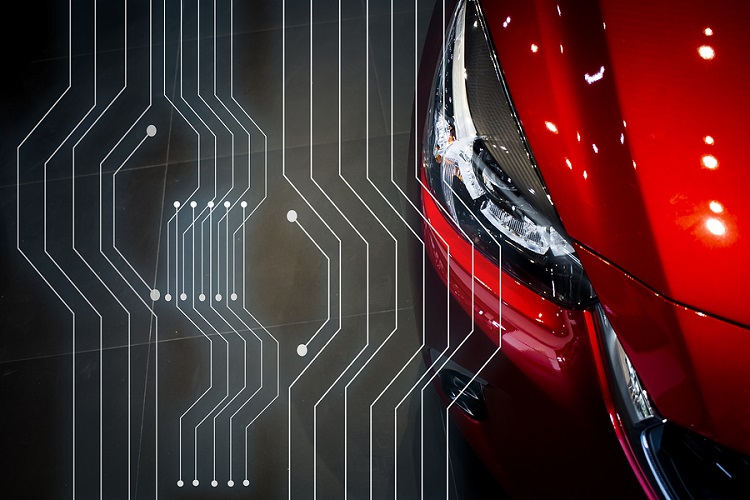

Continue readingVehicle Innovation: 3 Intriguing Developments

Automatic braking, lane control, backup cameras … we’re all familiar with vehicle innovations such as these. But what about the lesser-known developments in vehicle technology? What other innovations are brewing out there right now? Here are three contenders. Generate power with your tires Your tires create friction as they move over the pavement at high […]

Continue readingEverything You Need to Know about Offering a P&C Policyholder App

There are a lot of good reasons to offer your policyholders an app. Then again, there are a lot of good questions, too. To help you navigate that, we’ve put together a lightning-fast Q&A. Let’s dig in. Q. What’s so great about an insurance app? A. “The words ‘cool’ and ‘insurance’ are not often words […]

Continue readingWhat’s Happening in Telematics? News Roundup

It’s that time again! Let’s look at what’s new in the world of telematics. 1. At last, GEICO joins the telematics wave. The giant was holding out. But those days are over. GEICO saw that a major competitor that embraced usage-based insurance had “a significant advantage on the loss ratio side,” Insurance Journal said, and […]

Continue reading7 Rules for Scaling Policyholder Satisfaction

It’s impossible to talk about policyholder satisfaction without acknowledging how much the game has changed in the past 15 years. With the youngest Millennials in their mid-twenties and the oldest nearing their forties, we all know that it takes more than a logo to hold onto your customers. That’s as true in insurance as anywhere […]

Continue readingThe Future of Insurance: The Parametric Approach

Parametric insurance is all about parameters. To borrow from CRC Group President Garrett Koehn, it’s “if this, then that” insurance – and it’s about to get big. How does it work? Koehn gave this example: let’s say you live in Houston, and you have a parametric policy providing $5,000 in benefits should you experience a […]

Continue readingNavigating the Constraints of Direct-to-Consumer Insurance

The direct-to-consumer insurance sales model has the potential to reshape the insurance industry in its entirety – from the type of products sold, to the way they’re bundled; from how those products are distributed, to the role that agents and brokers play in the sale. But to everything, there is a limit. Which brings us […]

Continue readingDriving Trends: What’s Hot and What’s Not

Wondering what’s hot and what’s not? Here’s a quick round up of driving trends that may impact your insurance marketing and underwriting strategies. Hot: Sharing a ride According to the Census Bureau, the number of workers sharing a ride to the office is rising across major U.S. Cities, CityLab reported. Some cities are attempting to […]

Continue readingTen Ways IVR Can Power Your Insurance Growth

Interactive Voice Response (IVR) is doing a lot to power company growth for major players in life, health and P&C insurance. So, what can it do for you? Give you better info with less effort. For example, Humana uses IVR to provide insurers with a wealth of member info, including referral requirements, lifetime maximums, status […]

Continue readingWhat to Expect in Driving Data Regulation

Insurers are putting data to good use. As connected cars, mobile apps and telematics technology produce new streams of data, this information is facilitating improvements in underwriting, claims and customer relationships. There’s just one concern. While people love the faster processing, personalized offerings and deep discounts, they’re also worried about privacy. In a world of […]

Continue reading