Harvey and Irma: Is Insurtech Weathering the Test?

Insurance has seen a lot of disruption over the last couple decades. Those innovations have brought profound benefits to both policyholder and insurer during times of relative stability – but how do they fare during regional crises?

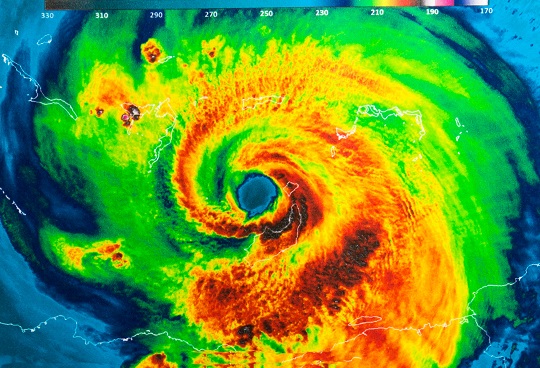

Here in the wake of Harvey and Irma, we’re finding out. These tropical storms represent “the first true catastrophe” since insurtech laid claim to innovation, according to Insurance Thought Leadership CEO Paul Carroll. We thought we’d take a look at how insurers are putting those tools to use.

Self-service & chatbots

Remote damage assessment can reduce the wait time on a claim, said Jay Sarzen, senior analyst at the research firm Aite Group. When individuals can send photos and videos on their damages, insurers can process claims more quickly. This information can also help alleviate the pressure insurers face on claims adjuster capacity.

Chatbots too can help things move more quickly. “Insurers have begun using chatbots, such as Pypestream’s, in their call centers, which should help handle the deluge of calls that will come in from customers and allow insurers to contact customers more often and more effectively to keep them up to date on the progress of claims,” Carroll said.

Drones

What if policyholders can’t upload pictures? That’s when adjusters arrive on the scene – climbing on roofs, slogging through mud and water, assessing damages, and expediting claims so that policyholders can get back to their lives as soon as possible.

“But with the hardest-hit areas still in search-and-rescue mode, some of those claims workers remain on standby,” said Ally Marotti at the Chicago Tribune. “Roads are impassable, and the insurance industry is left largely in the dark as to potential damages.”

In those cases – as well as when carriers need a better view of the damages – drones can help by gathering aerial data, said Sarzen. Sometimes their ability to collect visual data can keep adjusters out of harm’s way, too. When a drone is taking video of a roof, you don’t have to climb up there in person.

That said, drones do have limitations. They’re not a pure substitute for adjusters. “They cannot fly in heavy wind or rain, and they cannot go inside homes to inspect damage,” said Pat Eaton-Robb of the Associated Press.

On-demand adjusters

When an insurer’s regular team of adjusters are spread thin, and when drones can’t do the job, the gig economy may be able to help. Companies like WeGoLook provide an on-demand workforce that “can scale up and down rapidly in response to demand,” said Ahmad Raza at HuffPost.

Predictive analytics

Response is one thing. What about prediction? Here, insurtech has performed positively within recent weeks. “I’d say insurtech startup HazardHub wins early points for putting out an analysis right before the storm saying that $77 billion of property was at risk in Houston, quite a bit higher than other estimates I saw,” Carroll said.

Likewise, Ann Arbor startup EigenRisk provided forecasts on Harvey’s path of damage, sending automated warnings to help service teams communicate with clients about their risks. As the storm progressed, it switched to providing estimates of personal and commercial losses, sending updates within hours of new developments.

Predictive purchases?

One area where tech hasn’t made a significant difference for the victims of Harvey and Irma is in helping customers understand the need for coverage.

“The FEMA flood maps’ ‘binary’ approach – in or out of the 100-year flood zone – has not been effective in communicating all of the various flood risks to which homeowners are subject,” said Albert Slap, president of the analytics firm Coastal Risk Consulting.

But what if insurers could paint an accurate picture of the risk of tidal flooding, max storm surges in flood conditions, and heavy rainfall or high groundwater? Chances are, more people would buy flood insurance, and in a disaster scenario, fewer people would be weathering it unprotected.

Interested in learning more about insurance innovations? Download our free report, “11 Emerging Insurance Trends.”