Auto Insurance Strategy: How to Capitalize on Churn

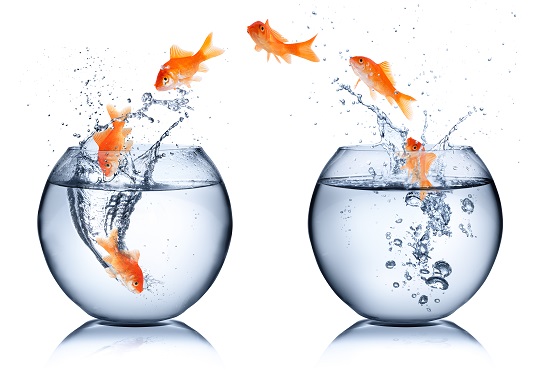

When CCC Information Services released their Crash Course insurance report, they drew an interesting line between the rate of vehicle sales and auto insurance churn. The line just got even more interesting this year, as car sales have continued to rise and, along with them, auto insurance customers have continued to jump ship. What does this mean for insurers, and how can you capitalize on an era of churn? Let’s look.

More car sales, more auto insurance churn

Why do insurance customers switch carriers? To find a better price, simply put. It stands to reason that when someone who’s been driving an older car replaces it with something a little more sleek, they’d have a reason to think about switching: after the purchase, their premium goes up.

“As consumers begin to replace older model year vehicles with newer, some may experience sticker shock when it comes to their auto premium,” said the report.

“Begin to replace” is an understatement. Consumers have been buying new cars left and right. Within the last handful of years, vehicle sales have risen from about 5.4 million in 2009 to 7.7 million in 2015, Statista said – an average annual growth rate of more than 7 percent.

And the trend is expected to continue. “Economic signs point to 2016 being the healthiest domestic auto industry in decades thanks to an improving labor market and low interest rates greasing U.S. demand,” said Gautham Nagesh at the Wall Street Journal.

If you connect the dots as CCC did, you may expect this rising sales trend to correspond in some fashion to rising insurance churn.

What does it mean for auto insurers? Two words: work harder

Again, CCC connected the dots. “As consumers become more discerning in who they do business with, and as more and more consumers rely on peer reviews and online referrals to influence their purchasing decisions, carriers will need to work harder to shape how they are perceived by current or prospective customers, and the ability for carriers to engage with those customers through social media channels becomes that much more important,” the report said.

Of course, working harder isn’t always the same thing as working smarter. In the current landscape, what should insurers be doing, specifically?

- Focus on channels. Customers use many channels, sometimes more than one within the same journey. “As a result, many insurers are focused on improving cross-channel customer experiences (63%) and improving the online customer experience (63%),” said John Cusano at Property Casualty 360.

- Look at customer experience, big picture. “Enhancing call center interactions (47%), mobile (41%) and social media (40%) tools are also areas of interest to improve customer experience,” Cusano said.

- Prioritize it. Sixty-two percent of carriers are still in the planning stages of a digital transformation. Only 14 percent feel they’ve mastered digital to the point that they can claim it as a differentiator. Only 9 percent believe they’re exceeding customer expectations with the digital experience they offer.

- Attain the insight to improve. In the midst of these weak points, lack of analytics remains a ball and chain: preventing insurers from accessing the insight they need to make targeted improvements. “In order to sustain continued investment in digital transformation, insurers must be able to measure and prove the value of their strategies,” Cusano said.

- Move quickly. A rising rate of churn is good for those that are poised to capitalize on it, bringing in new customers who are primed to switch. It’s not at all a good thing for those that are unprepared to weather it.

Want to capitalize on the era of churn? Having the right P&C software system makes it easier. Learn more about how to leverage the Five Mobile Game Changers in our all new report. Download it here.