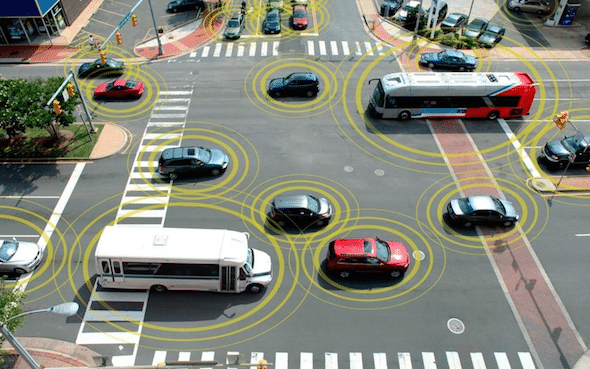

Telematics in 2021: Have We Reached the Tipping Point?

Consumers may be ready to embrace telematics – even if insurance professionals don’t realize it yet. Here’s why 2021 may see a surge in the use of telematics.

Business Owners Are Interested in Telematics

Insurance agents are missing out on opportunities if they don’t talk to their commercial auto clients about telematics. That’s a takeaway of a survey from Nationwide, which found that 14% of agents don’t think clients with fleets would pay anything for telematics, even though 93% of businesses say they value the safe driving culture that telematics helps enforce. Agents also underestimate how much business owners would pay: 70% of business owners would pay $20 to $39.99 per month per vehicle but more than 60% of agents think clients would pay $29.99 or less.

Among business owners who haven’t adopted telematics, the survey found that the biggest reason boils down to a lack of knowledge. Agents could help fix this by discussing telematics with their commercial clients.

Personal Auto Insurance Buyers May Be Interested, Too

Business owners aren’t the only ones who may be more open to innovation than insurance professionals realize.

A survey from Deloitte found that U.S. auto insurance consumers are comfortable with traditional coverage, but they’re also open to alternatives, especially if they provide greater control and flexibility. Interestingly, to receive lower premiums or suitable coverage, 56% of home and auto insurance customers are willing to share data on how they drive (such as speeding, braking and turning), 55% are willing to share data on where they drive, and 77% are willing to share data on vehicle usage (such as distance driven and time of driving) – exactly the sort of information used in telematics and usage-based programs.

In some cases, whether or not consumers are receptive to telematics might come down to how options are presented. For example, the Deloitte study suggests that “usage-based insurers could emphasize that standard coverage is limited in its pricing customization capabilities, then show how a connected policy could reward good driving and save them money without a significant loss of privacy.”

The Need Is Increasing

There’s another reason to think that telematics might become more popular in 2021. Auto insurance rates are rising. According to Business Insurance, commercial auto rates were up 8% in the third quarter of 2020. Fleet owners need a way to get insurance costs under control. If that way is telematics, many will embrace it.

Individuals want a good deal, too, and no one wants to pay for insurance they aren’t using. According to Business Insider, a J.D. Power study found that the car insurance industry issued more than $10 billion in rebates during the pandemic, but consumers still weren’t satisfied, and many planned to switch carriers. Telematics offers an alternative that could be very appealing to people, especially if it’s presented right.

Leaning In

Now, more than ever, insurers must understand and adapt to the trends driving the industry. At Silvervine, we provide a variety of tools to help you stay light on your feet in a rapidly-shifting landscape. Request a demo or contact us to learn more.